Happy Chinese New Year, my Chinese readers! Staying true to my Chinese roots, I’m talking about money on the first day of the Lunar New Year. (chuckle)

As I mentioned in my first money diary post, I’m not a tracking kind of person. I find the act itself tedious, and it’s common for me to be on fire for a couple of days tracking something … only to have it fizzle out after a week. So, the fact that I managed to loyally track my expenses for an entire freaking month (ok, 3 weeks), is a huge achievement for me.

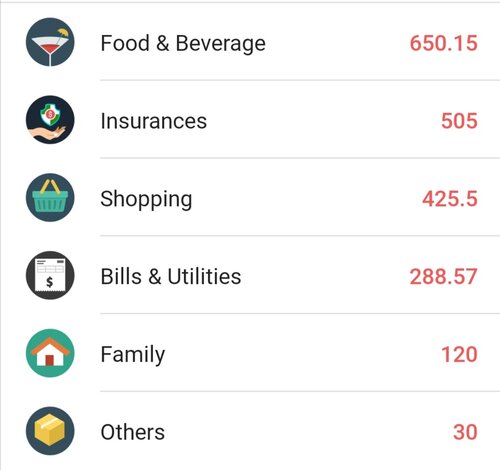

I used the app Money Lover to track my expenses. (I like the colourful reports it produces and also how easy it was to track things.)

Here are the results for January:

RM2019 in total expenses, I suspect, is on the low side for me, and I’m quite convinced that this is largely influenced by the stricter MCO (lockdown) imposed by the Malaysian government in the last few weeks. I stayed mostly home, didn’t eat out and being a non-shopper type of person, didn’t buy much either.

Spending breakdown

Food and Beverage – RM650.15

This current MCO barred restaurants from having dine ins, which meant that my restaurant visits were cut down to zero. And unless I am living with my parents, I hardly ever order food from Food Panda, instead, I cooked more. Still, I ordered a good deal of takeout because I am often far too busy to cook due to the demands of my full-on job.

My bubble tea habit is fattening my food bill. (And most probably me as well.) Yes, I created a Bubble Tea category because I suspected that my habit is getting out of hand! January is one of my more “controlled months”, so I suspect that in previous months, I may have spent RM200 on the habit alone. In January, I spent RM101.76.

I probably also need to create a Diet Coke category in February cos my bro commented that I bought a lot last month. (yikes)

As a result of this findings, I ordered pre-made boba pearls from Lazada to make my own bubble tea. Once upon a time, I actually made my own pearls, but it’s very time consuming to make them and with my full-time job it’s just not feasible anymore. I soon started making my own bubble tea drinks, so I think this is a step in the right direction.

Now that dine ins are allowed once more, I wonder if my F&B expenses will go up to RM1000 in February?

I’ve always been a foodie – it’s one of the allowances I’ve given myself to, you know, enjoy life more. Sure, I can cut down the bill to just RM300 a month and I did that during the lean months after quitting my job last year to freelance, but life is meant to be enjoyed, and that ‘s why I’ll keep my F&B expenses in this RM600-700 range.

Shopping – RM425.50

The majority of my shopping bill comes from groceries (RM366.60), and I suspect a large percentage of it went to Diet Coke (lol). Groceries include things like toiletries, food and other miscellany. In January I bought some clothing. It was long overdue – my mum threatened to buy me new underwear if I didn’t, so it was as good as time as any to do it before she carried out her threat. RM58.90.

Family – RM120 and Others – RM30

Under the “Family” category are expenses I paid to maintain the home. RM120 to service my apartment’s air-conditioning. “Others” is what I paid for a coworking hot desk (RM30) before the MCO was imposed.

January Reflections

1. Savings and Investments – still mostly on autopilot

I invested about 15% of my income and dropped a big chunk from my savings into EPF (Malaysia’s retirement accounts.) In case you’re unaware, you can self-contribute on top of the monthly contributions that are being taken of your salary. I try to self-contribute about 10% of my income every month. Last year, I had to halt that for a while after leaving my job, which is why I dropped an amount about 60% my salary in January to make up for lost time.

2. I’m ruminating on too many sad things

The MCO really did a number on my mental and physical health. There was one week where my energy was so crap that I could barely focus at work and all I wanted to do was crawl into bed and forget that I existed. I missed tending to my vegetables under the morning sun. I missed being in a busy cafe while I read and journal. I missed doing laps in the swimming pool, damn it. With so many things that gave me joy gone, no wonder I was (and still am) struggling.

Malaysia’s politics and miserable handling of COVID-19 added fuel to the fire. (I really need to stop doomscrolling.) Too much time alone is just not good for this ENFP.

My mind was also on a negative spiral about my career. I’m not sure if it’s because I’m absorbing the laments of people around me or because I truly think my career is in the dumpster, but having no one to bounce off ideas, thoughts and laugh with has made this extroverted person ruminating on all the wrong things.

Whenever I’m on this spiral I remind myself that where I am now is where I wished I was when I was a subeditor struggling with night shifts and longing for a new career direction. It’s funny how we’re never satisfied when we reach our desired destination, but always wonder if there’s something better on the horizon.

3. Being a listening ear to people takes a toll, especially when you’re down in the dumps yourself

As much as I want to help and lend a listening ear, it’s hard to not be impacted by their negative emotions when one of your CliftonStrengths is Empathy. We’re literal emotional sponges, and while people feel better after they unload on us, we are left to deal with the negativity that has seeped into our psyche.

In January, I just couldn’t anymore. With so much negativity in my life, it was incredibly tough to absorb other people’s pain. Perhaps, during this difficult time, I have to make the difficult but necessary choice to cut off negativity of any kind. I don’t have much positivity left in me, and I need to take care of myself first.