Kenanga Digital Investing (KDI) says that it’s a “fully automated artificial intelligence-driven robo advisor designed to simplify how you save and invest.”

KDI offers two products: KDI Save and KDI Invest.

KDI Save

With their money market product, you will get 3% fixed interest rate until December 2022, which makes it one of the most competitive money market funds out there and better than most fixed deposit (FD) rates as of this writing.

There are no lock in periods, so unlike FDs, you can transfer your money in and out or switch them to KDI invest, which makes it a convenient place to park your money while waiting for an investment opportunity.

You earn daily returns and there are no management fees for KDI Save.

Currently, until Dec 2022, you can put up to RM200,000 in KDA Save and still be eligible for the promotional return rate of 3%. After that, you have a base return rate of 2.25% per annum.

KDI Invest

Focuses on US-listed exchange traded funds (ETFs). However, what these ETFs are is a mystery because when I signed up, I could not find out what I’m signing up for in terms of the ETFs I’m investing in. I cannot find detailed information about the ETFs they invest in on their website, nor on my account dashboard. This lack of transparency is exasperating and downright irritating for people like me who prefer to do their due diligence before committing to any platform.

I only found the type of ETFs KDI Invest is using when someone shared his KDI statement with a forum Apparently KDI will only tell you the ETFs you are invested in when it provides you a monthly statement. That’s pretty maddening, because Stashaway and Wahed allow you to get these details almost instantly.

As a person who wants more control, I really want to know exactly what I’m invested in and in what portion before I put money in an investment account. Why doesn’t KDI provide this when so many robo advisors provide this? So, that’s one minus point for KDI invest. Hopefully this is a temporary blip and they will fix this soon.

Investment methodology

You know, I wish robo-adivsors will straight out tell you if they have an active or passive investing style. Instead, they say things like how they integrate a “multi-faceted approach from data analysis, machine learning, asset allocation to trading and rebalancing.”

In a blog post, KDI Investment Philosophy – Pushing Investment Boundaries with A.I, you can get some hints of its investment methodology:

- Assets are allocated using the principles of Modern Portfolio Theory

- “Dynamic”, automatic rebalancing by AI — just when and how often, not sure

- “Downside protection strategy”— in the event of market volatility, KDI will switch risky assets into low-risk assets to protect investments, which hints of a more active investing style

KDI states that in 2018, research from S&P Dow Jones index indices stated that 90% of active fund managers underperform the market over the past 15 years. The fund managers’ underperformance hasn’t changed. A 2022 report says that 79% fail to outperform the S&P index in 2021.

KDI claims that they have designed its AI technology to ensure minimal human intervention.

But is the problem just humans?

The truth is most active fund managers underperform the market not just because they’re human but also because funds are saddled with high fees. Fund managers also have a more active investment style, meaning they’re constantly buying and selling stocks in a bid to outperform the market. Each transaction cost adds to the already high fees. Fees eat into investment gains. Also, since it’s more or less acknowledged that it is futile to time the markets, and since most fund managers are not clairvoyant, they can’t predict what’s going to happen to any stock. Yet, try they do.

“It costs more for active managers when they’re trying to compete with the S&P 500 that is essentially free through the ETF wrapper,” said Todd Rosenbluth, CFRA senior director of ETF and mutual fund research in that CNBC article.

KDI claims that its AI addresses the human elements of emotion and lack of ability to process a large volume of data efficiently. They have “superior risk adjustment with continuous machine learning” using something called the “AI factor analytics machine learning engine” to estimate the portfolio’s volatility accurately. I suppose this gobledygook means that their algorithm will rebalance your portfolio when necessary to optimise your returns.

Apparently, they use backtested model portfolios which are designed by their AI. These models have yielded an average annual return rate of 7.3% to 16.7% from 2004 to February 2021.

Time can only tell.

Update, August 2022

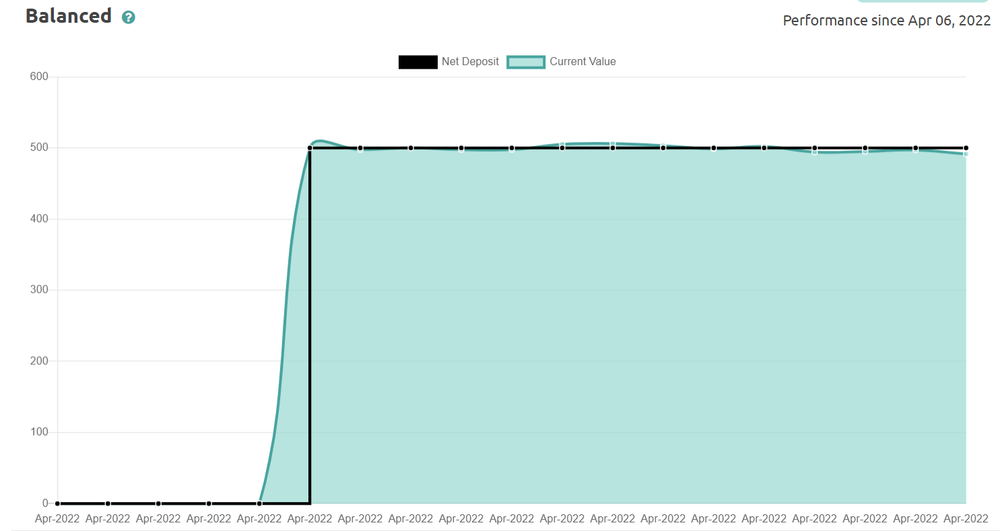

Well it would seem that they have an Active strategy.

I think the disappointing thing is that I wasn’t informed that they were going to switch out my funds from a balanced portfolio into a conservative one. The lack of information etc, is concerning, and I hope KDI improves on their communication so far. Still, I did originally want a conservative portfolio anyway, so I wasn’t terribly disappointed, but I wondered what loss have I incurred with the move.

However, let’s say you view the downturn in equities as an opportunity to buy ETFs or shares at a lower price, and you funnel more money into the portfolio … only to discover you were switched out. So if you have this strategy, you may have to reevaluate your position in KDI. I use KDI only to get access to the money market and also to access foreign fixed income. Since they’re charging 0% fees until RM3000 invested, I think that’s worth it.

Pricing or Fees

KDI Invest gives you 0% annual management fee for funds RM3000 below. This is probably the most competitive fee for a roboadvisor in Malaysia to date. You’re essentially buying ETFs without having to bear the usual roboadvisor annual management fee, as long as you invest below RM3000. (This is even cheaper than the DIY method. Each time I buy an ETF from a broker, I incur brokerage fees, which can be quite high.)

The expense ratios for KDI’s ETFs range from 0.2% to 0.4%. This is a fair fee, though Vanguard’s VT has an expense ratio of 0.06% which is a steal for an ETF that covers the world markets.

Currency Exchange is 0.2% of transaction value, and I like that they state it up front. KDI does not charge fees relating to sales, subscription, redemption, custodian, withdrawal penalties or closing of account.

Please also note that Malaysians investing in US shares will incur a 30% withholding tax on dividends.

Investment returns shown on the KDI dashboard are net value after initial returns are offset by fees and charges.

ETF selection

KDI invests in, from what I can see from information shared by people in forums, reputable ETFs with low expense ratios and a long history of good performance such as

- VT — Vanguard Total World Stock Index Fund ETF

- VNQ — Vanguard Real Estate Index Fund ETF

- BNDX — Vanguard Total International Bond Index Fund ETF

All this depends on your risk level, of course. And it seems that not all portfolios would have the same ETFs, even if they have same risk level. At least, this is what some forumers say.

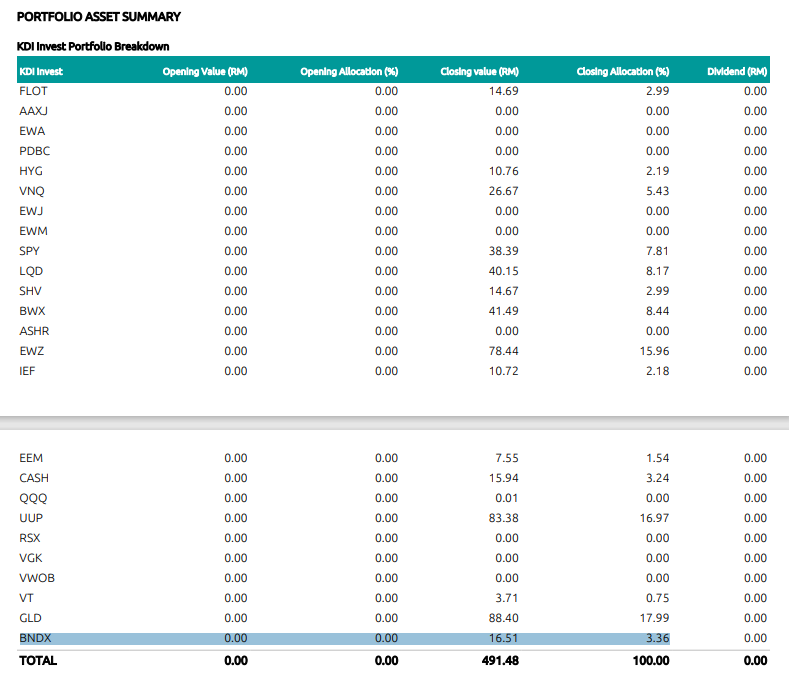

This is my first KDI statement, and from there you can see the list of funds I’m invested in.

Bond ETFs

- iShares Floating Rate Bond (FLOT)

- iShares iBoxx $ High Yield Corporate Bond ETF (HYG)

- Vanguard Total International Bond Index Fund ETF (BNDX)

- SPDR® Bloomberg International Treasury Bond ETF (BWX)

- iShares iBoxx $ Investment Grade Corporate Bond (LQD)

- iShares Short Treasury Bond (SHV)

- iShares 7-10 Year Treasury Bond (IEF)

REITs

- Vanguard Real Estate Index Fund (VNQ)

Equity ETFs

- SPDR S&P 500 ETF Trust (SPY)

- iShares MSCI Brazil ETF (EWZ)

- iShares MSCI Emerging Markets ETF (EEM)

- Vanguard Total World Stock Index Fund ETF (VT)

Commodities

- SPDR Gold Shares (GLD)

Currency

- Invesco DB US Dollar Index Bullish Fund (UUP)

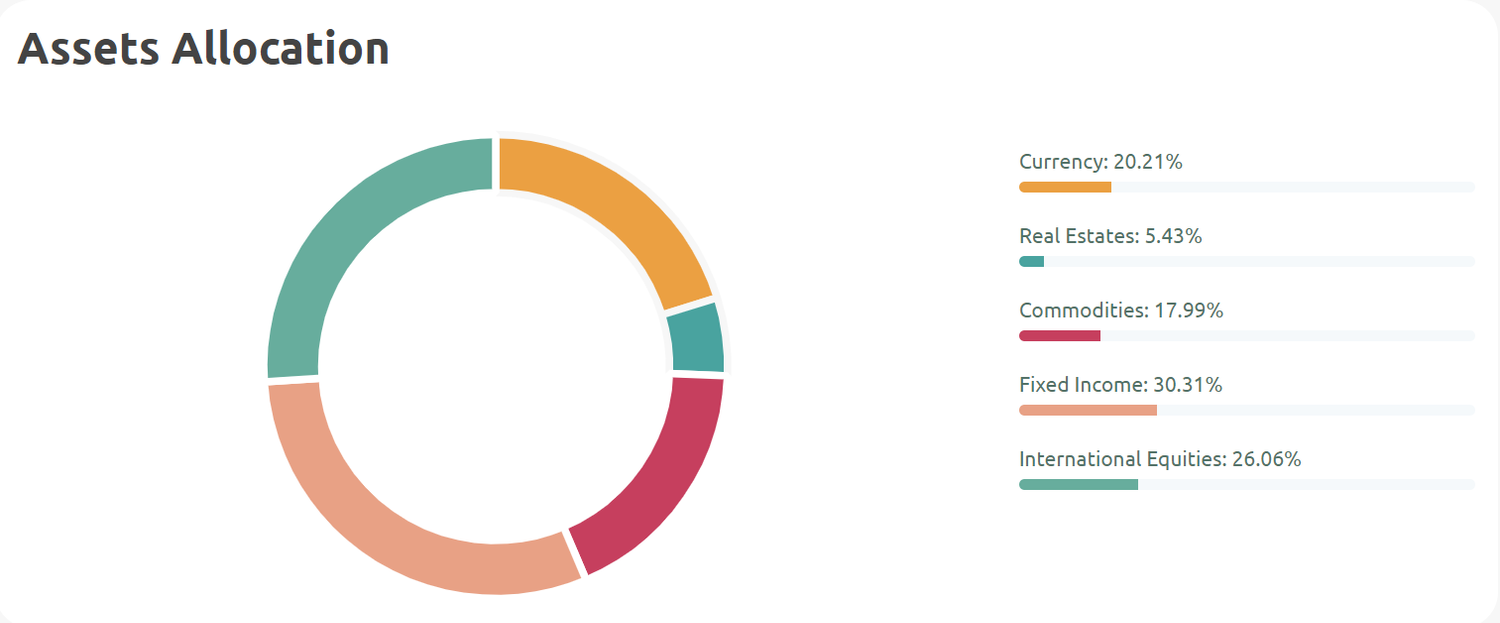

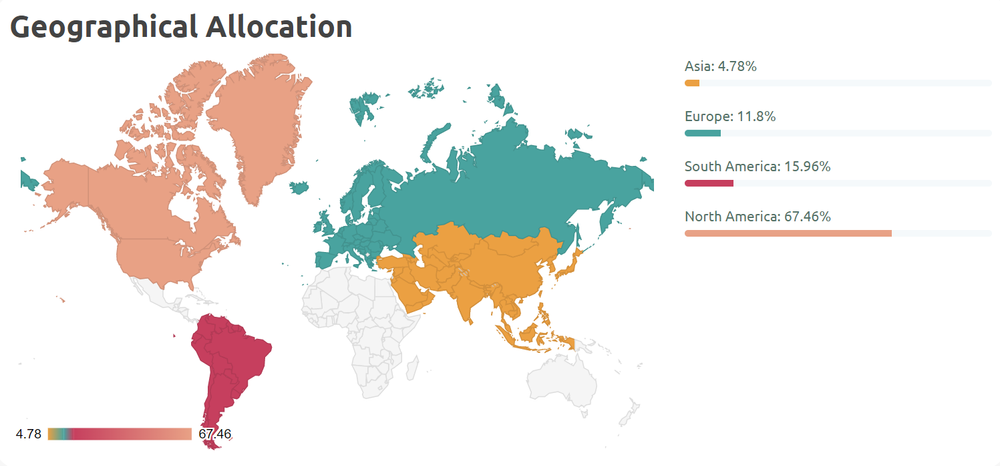

All in all, I’m pretty pleased with the selection of ETFs in my portfolio as it’s diversified, even if I think the number of ETFs I have is overkill.

I’ve been looking for a cost-effective way to increase my international bond allocation excluding the United States (US bonds are not doing great right now) so I’m glad to have BNDX and BWX in my portfolio.

My equity ETFs cover the famous S&P 500 index (yipee) and also includes international equities. Also happy to include an emerging market ETF in the mix too. Although they tend to be riskier, there’s lots of growth potential in emerging markets. And as a fan of REITs, can I say how chuffed I am to have VNQ too? UPP on the other hand, offers exposure to a basket of currencies relative to the US dollar. It provides you “exposure to the dollar against a broad range of developed market currencies”.

As I study the ETFs further, I’m pleasantly surprised to see that the bond funds are pretty diversified; I have different types of bonds such as corporate, treasury, high-yield, international and even floating rate bonds. Same goes for equity, though SPY and VT stocks do overlap somewhat.

Pros

KDI invests in reputable, mostly low-cost ETFs

I’m smiling because I now have easy access to reputable funds like BNDX, VNQ, SPY and VT.

KDI invests in US-listed ETFs because of their high trading volume, which means it’s easy to buy and sell these ETFs. They are also data-rich, which allows KDI’s AI to “improve its predictions continuously”.

Ability to invest in fractional shares

Just one SPY share costs around US$419 at the time of this writing. But as we can invest in fractional shares, you can buy fractional SPY shares with just a small capital. KDI investors can start investing at RM250.

Easy to use

The website and app is super easy to use. I prefer to do my finance stuff via desktop, so I’m really glad KDI is not app-only.

Cons

Lack of information

The information on their website is surprisingly thin. For one, the lack of list of ETFs, for one, is a big pain point for me. I prefer knowing what I’m getting into, and it annoys me that I’m not given more information on what I’m investing in and how the portfolios could look like before plonking my money down. I’d like to make informed decisions on my investments, and getting the information only on the first day of each month is limiting and rather old-fashioned.

Here’s what I see on my KDI Invest dashboard:

User Interface needs work

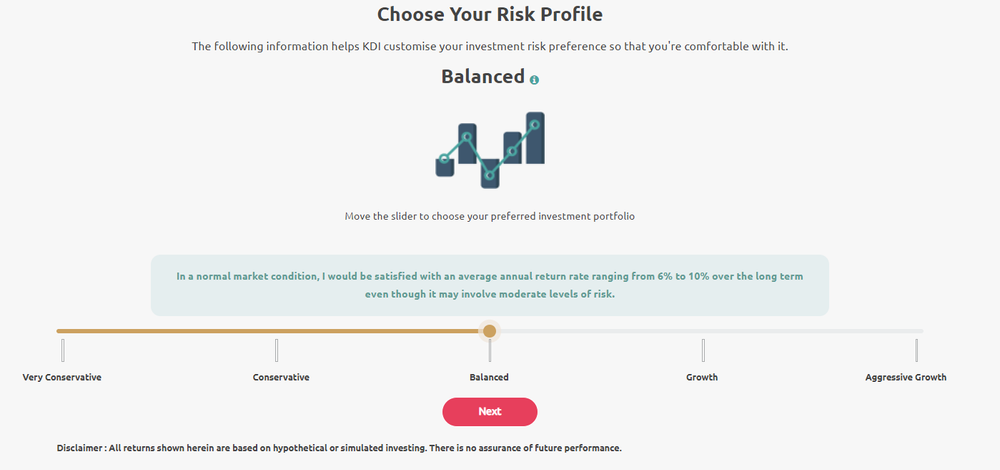

When you sign up, like most robo advisors, KDI will ask you a series of questions to determine your risk profile. I somehow ended up chosing a Balanced portfolio and the craziest thing is I couldn’t seem to change it. I tried everything I could to change my portfolio before putting a single dollar and I couldn’t find the option to do it. In the end I gave up and went with the Balanced portfolio.

Later, I had to go to a forum to find out how to do change my risk profile!

- Click on “My Account”

- Click on “My Profile”

- Click on “Edit Risk profile”

I’m glad I finally found the solution, but I wished I had discovered it before I added money to the account.

I shouldn’t have to head to a forum to find out how to do this! lol

Bare bones functionality

You can deposit and withdraw your money. But I don’t see any option to create more than one portfolio, or automate your deposits, which is puzzling.

Lack of control

I’m awaiting the day when a robo-advisor like M1 Finance, which allows you to select your ETFs, comes to town. Until then, using a robo-advisor, even with one with such a good basket of ETFs like KDI, is to hand over that power to an algorithm.

Final word

KDI has lots of potential, especially since they provide easy low-cost access to reputable funds like SPY, VNQ and VT. If you’re a beginner investor and can only invest in small amounts, KDI is a great place to start, especially since they don’t charge an annual fee until your investments exceed RM3,000.

KDI Save is also stellar, and seems to offering the best money market rate in the market, at least in 2022. A great place to park your money to get better rates than FD.

The downsides is the less-than-perfect UI, lack of control, little information about its ETF funds and no automated scheduled deposits, which I find puzzling.

Still, it’s early days. KDI may add more features and improve its UI over time.

Cross fingers.

PS: I will continue to update this blog post as KDI makes improvements.

Referral code, since I believe this is helpful: Sign up for KDI via this link and use the code 107178. You will earn RM10 when you invest more than RM250 with this code.

Subscribe to my newsletter to get updates on new blog posts and exclusive essays and fiction.